Savvy Ways to Save Money as a Student

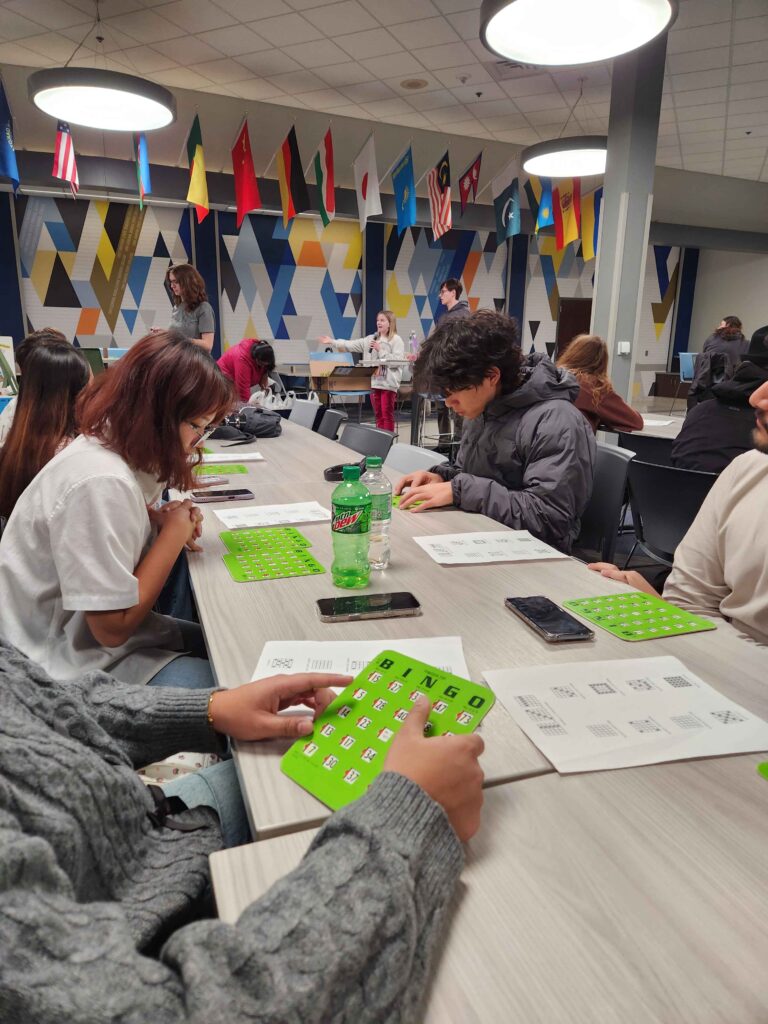

Photo Credit: Martha Abbey Miller

Scrounging for coins under the car seats or on the streets. Chasing a dollar blowing in the wind on the sidewalk. Asking for a student discount to every restaurant you go to. Becoming overly excited when an event has free food because it means you will save a couple bucks. Don’t worry, I do all of these things too. Hopefully, these savvy and unconventional ways of saving money as a student will make you (somewhat) richer!

As students, there are many things that take up the majority of our money: Tuition, food, rent, entertainment, textbooks, etc. In some of these areas, I hope to shed some light on how you can save at least a little bit of money on them!

- Tuition: Nope, they are no loopholes when it comes to tuition or paying for college. The price is pretty much non-negotiable, unless you find a mistake the cashier’s office made and bring it to their attention. School cost thousands of dollars, and there is just no getting around that. However, there are ways to ease the financial burden:

- Payment plan: The payment plan DSU offers allows you to pay your school bill in ‘small’ installments each month throughout the semester. Personally, the payment plan has allowed me to live well all semester long, instead of starving for a month in August, as I hand off all my money to the school.

- Work Study: Not all students qualify for work study. If you are not sure whether you do or not, talk to the Financial Aid office. Work study positions are generally offered on campus, and range from office to labor jobs. Students are offered a reward of usually $1,000 or more. This allows the student, on average, to work 8 hours per week. At the end of each month, you can elect whether your paycheck is applied to your bank account or to school bills.

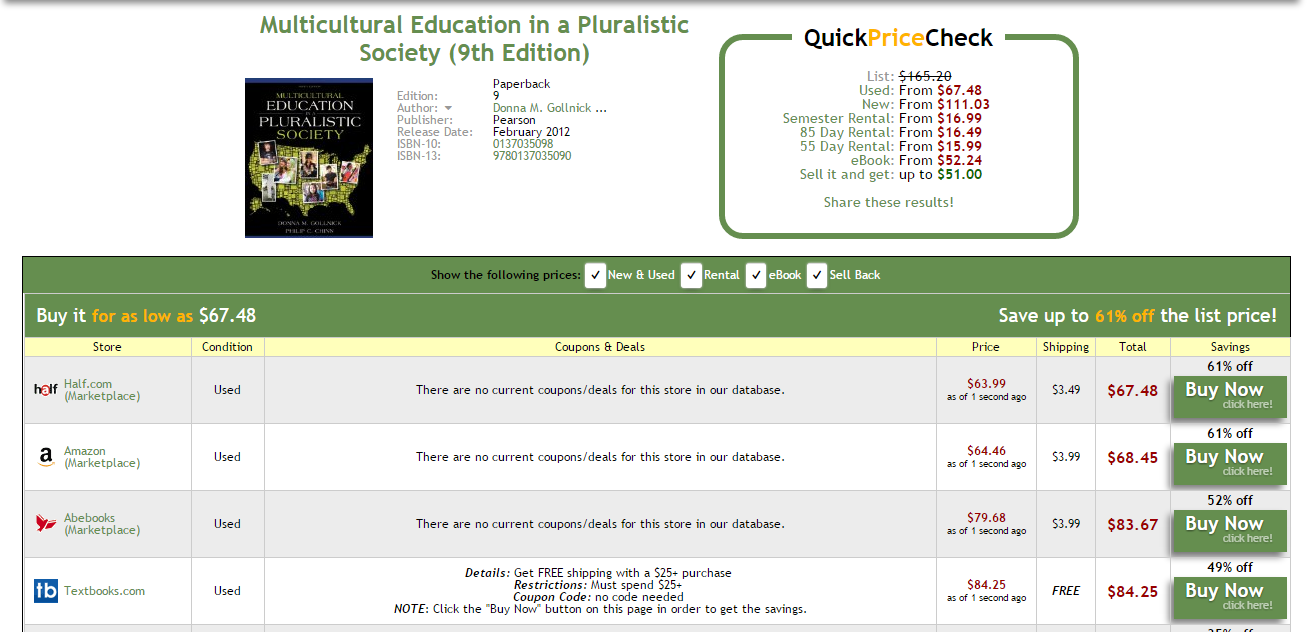

- Textbooks: Like you, I don’t understand how a book we use only a few times in certain classes can cost so much money. There are plenty of great resources out there that can help you find the best choice of textbook for you.

- com: This website is a fantastic price comparison tool. It compares textbook prices from dozens of sites. It also separates the prices into rented new, rented used, buying used and buying new.

- Renting: Occasionally, some of my required textbooks will be well over the $100 mark. When this happens, I know that renting is my best option. No, you can’t resell the book at the end of the semester. However, I find that renting doesn’t take as much out of my bank account for that certain month.

- Food

- Off-Brand: It is common knowledge that off brand food items are generally cheaper than the name brand ones. That doesn’t mean they can’t taste as well! I guarantee that you won’t be thinking about the difference in taste once you see your bank account go up at the end of the month.

- Farm Fresh Eggs: Several people in Madison sell farm fresh eggs that are cheaper by the dozen than at the store. Eggs are also a great source of protein, as meat is pretty expensive these days. The quickest way to find out who sells them in Madison is to post a question on the Madison rummage sale site on Facebook called, “Recyclepath.” You will most likely get lots of responses and names of people who sell fresh eggs.

- Sunshine Coupons – Each month, I receive coupons for Sunshine Foods. The deals are great. If you are interested, ask a clerk at the store for more information on how you can receive the coupons each month.

The most important rule to consider when you want to save money: be creative! There are plenty of ways to save money as a student. Happy saving!